TheGodOfWealthIsMy

- Reward

- like

- 9

- Share

ThisYearIWillHaveSm :

:

Can a little pattern surpass OKB's father and BNB's grandfather?View More

US stocks ended higher with the Nasdaq adding 0.26%, marking the fifth session in six that the technology-heavy index has posted a record close

SIX-0.44%

- Reward

- 15

- 8

- Share

Lionish_Lion :

:

FOLLOW ME if you want real trading education. No fluff, just actionable market insights. 💡📈View More

Data shows: Sui attracted $310 million in funds flowing from Ethereum, with TVL exceeding $600 million.

The Sui network has recently seen significant asset inflows, with approximately $310 million migrating from Ethereum to Sui, indicating rapid growth in its ecosystem. Sui's Total Value Locked has exceeded $600 million, making it one of the top 10 in Decentralized Finance, attracting a large amount of stablecoins such as USDC and USDT. Sui plans to launch multiple new projects to further enhance its influence and appeal in the DeFi space.

- Reward

- 16

- 7

- Share

LiquidationWatcher :

:

The opposing position is about to get liquidated again.View More

Frequent security incidents trigger industry turmoil. How should investors respond to the challenges of the Crypto Assets market?

Recently, the Crypto Assets industry has frequently experienced security vulnerabilities, causing panic among investors. The industry faces issues such as a lack of security standards and asset accomplice. In such an environment, investors need to carefully choose platforms, diversify risks, enhance personal security awareness, and seize investment opportunities amid market panic.

- Reward

- 9

- 7

- Share

RugResistant :

:

Cautiously bearish, the main strategy is sun conspiracy.View More

Crypto Assets market makers seek to raise 200 million USD, which may involve equity changes.

A London-based cryptocurrency market maker is seeking to raise up to $200 million, part of which will be used to help a Tokyo company reduce its 90% stake. The market maker's subsidiary acquired a 90% stake in 2020 after investing $30 million.

- Reward

- 8

- 7

- Share

MEVHunterBearish :

:

Speculating on suckers that have been played.View More

Analysis of Legal Risks and Operational Recommendations for the 5 Major Channels of Crypto Assets Exchange

Legal Risks and Operational Recommendations for Crypto Assets Exchange

Recently, many people have inquired about the legal risks and practical operation methods of exchanging Crypto Assets (especially USDT). This article will briefly explore the legal risks and feasibility associated with some current exchange channels, aiming to help everyone use and dispose of Crypto Assets legally and in compliance.

It should be noted that this discussion is only for ordinary users whose sources of funds are legal and who purchase and hold Crypto Assets solely for personal daily consumption and normal investment activities.

1. Hong Kong licensed Crypto Assets exchange and brokerage channels

Currently, the Hong Kong Securities and Futures Commission has authorized licenses for 7 crypto asset exchanges (or operating entities), demonstrating the thriving trend of crypto assets in Hong Kong.

Based on practical experience, exchanging USDT through Hong Kong channels is a relatively legal and compliant way with lower legal risks. However, it should be noted that currently, USDT and other Crypto Assets cannot be directly traded on licensed exchanges.

Recently, many people have inquired about the legal risks and practical operation methods of exchanging Crypto Assets (especially USDT). This article will briefly explore the legal risks and feasibility associated with some current exchange channels, aiming to help everyone use and dispose of Crypto Assets legally and in compliance.

It should be noted that this discussion is only for ordinary users whose sources of funds are legal and who purchase and hold Crypto Assets solely for personal daily consumption and normal investment activities.

1. Hong Kong licensed Crypto Assets exchange and brokerage channels

Currently, the Hong Kong Securities and Futures Commission has authorized licenses for 7 crypto asset exchanges (or operating entities), demonstrating the thriving trend of crypto assets in Hong Kong.

Based on practical experience, exchanging USDT through Hong Kong channels is a relatively legal and compliant way with lower legal risks. However, it should be noted that currently, USDT and other Crypto Assets cannot be directly traded on licensed exchanges.

- Reward

- 18

- 7

- Share

SchroedingerMiner :

:

Stay away from black and gray industries.View More

The crypto market is experiencing a major shock, while some public chains are rising against the trend. Key events are approaching next week.

This week, the Crypto Assets market has significantly fallen, with the market sentiment index dropping to 11%. The panic is due to the theft incident on the platform and concerns about economic recession. A few projects like LTC and SOSO are attracting attention due to high APY, but overall, there is still uncertainty, and investors are advised to operate cautiously.

- Reward

- 5

- 7

- Share

Lionish_Lion :

:

FOLLOW ME if you want real trading education. No fluff, just actionable market insights. 💡📈View More

Recently, I had the privilege of having an in-depth conversation with a seasoned project operator in the Web3 field, whose experience provided me with a new understanding. This expert achieved approximately 420,000 RMB in profits in just one month by operating 200 accounts this May, with costs of only about 80,000. Behind this astonishing result lies not just a simple quantitative advantage, but the ultimate application of matrix operation strategies.

His secret to success is mainly reflected in two aspects:

First of all, the value of trust relationships far exceeds technology. This expert has

His secret to success is mainly reflected in two aspects:

First of all, the value of trust relationships far exceeds technology. This expert has

BR0.02%

- Reward

- 6

- 6

- Share

RektRecovery :

:

Average gray areaView More

The operating mechanism of the market often contradicts people's intuition. Usually, it is not because favourable information has emerged that the market rises, but rather that after the market rises, favourable information will follow. This phenomenon reflects an important characteristic of the market: price changes often precede the dissemination of information.

In fact, the market does not rise because 'people know something first', but rather 'after it rises, people start to look for reasons'. This phenomenon reveals a key issue in investing: can investors position themselves in advance wi

View OriginalIn fact, the market does not rise because 'people know something first', but rather 'after it rises, people start to look for reasons'. This phenomenon reveals a key issue in investing: can investors position themselves in advance wi

- Reward

- 14

- 6

- Share

DefiSecurityGuard :

:

DYOR is keyView More

Bank of America CEO: Unclear regulation on stablecoins, no plans for large-scale adoption.

[Coin World] Bank of America CEO Brian Moynihan reiterated the bank's cautious stance on stablecoins during a conference call for its earnings report on Wednesday, pointing out that the regulatory environment remains unclear and customer demand is lacking. Although the bank has "done a lot of work" researching stablecoins, Moynihan emphasized that adoption will depend on a clear legal framework and actual demand.

- Reward

- 17

- 6

- Share

StakeOrRegret :

:

Again putting on a bureaucratic air.View More

Is the claim available for edition collectors or only for the auction winners? I have an edition but can't claim

AUCTION-1.45%

- Reward

- 8

- 6

- Share

PuzzledScholar :

:

It may not be enabled yet.View More

The encryption market maker B2C2 seeks to raise $200 million, SBI may reduce its stake.

SBI Holdings, which holds a 90% stake in the Crypto Assets market maker B2C2, is seeking external investors to raise up to $200 million to help SBI Holdings reduce its stake. Both B2C2 and SBI Holdings declined to comment on the matter.

B2-4.21%

- Reward

- 8

- 6

- Share

gaslight_gasfeez :

:

The funds have been trapped.View More

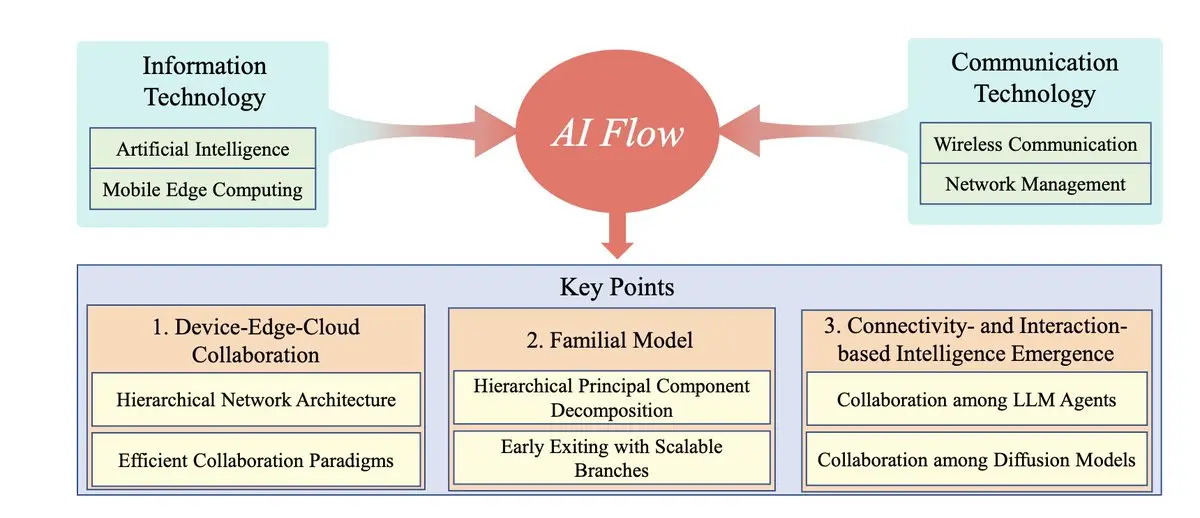

The new "AI Flow" framework by a Chinese telecommunications institute introduces a game-changing solution: task-oriented feature compression.

Instead of sending raw, bloated data, it compresses only the essential features needed for each specific task.

Instead of sending raw, bloated data, it compresses only the essential features needed for each specific task.

FLOW0.52%

- Reward

- 12

- 6

- Share

AltcoinHunter :

:

The future is promising and worth looking forward to.View More

2024 Web3 Outlook: DeFi Regulation, Game Innovation, and New Opportunities for NFT

The article looks forward to the development of the Web3 field in 2024, emphasizing the innovation of blockchain technology and its deep integration and maturation in the Decentralized Finance, Web3 gaming, and NFT markets. The Ethereum ecosystem will drive significant technological advancements, regulatory transparency and cross-chain interoperability will be significantly enhanced, and it is expected to attract a broader range of market participants.

DEFI-4.79%

- Reward

- 12

- 6

- Share

RunWithRugs :

:

The bull run is about to come, right?View More

Bitcoin may break $110,000 this week as the altcoin focus shifts to BSC and Base chain.

The cryptocurrency market is undergoing changes, with the altcoin hotspot shifting from Solana to BSC and Base chain. Analysts are optimistic about Bitcoin's short-term trend, expecting it to break through $110,000. Meanwhile, non-farm payroll data has alleviated concerns about an economic recession, and the market is following recent macroeconomic data and the launch of several new projects.

BTC0.29%

- Reward

- 14

- 6

- Share

GhostInTheChain :

:

Bullish means now.View More

This is a long-term journey in generative form, code, and concept.

Each piece is a building block.

Each chapter deepens…

Each piece is a building block.

Each chapter deepens…

FORM19.59%

- Reward

- 8

- 6

- Share

HashBard :

:

The road gets longer and longer.View More

- Reward

- 9

- 6

- Share

AirdropChaser :

:

I am very happy that the Bear Market is about to start.View More

BTC rises after breaking new highs: Can it become the new engine of the U.S. economy?

The current fluctuations in the crypto market are mainly due to the anxiety over the value rise after BTC's price broke new highs. The market's expectations for BTC as an anti-inflation tool are being challenged, especially after a certain tech giant refused to include BTC in its asset allocation, leading to price volatility. Although BTC is unlikely to replace gold in the short term, its potential as a new strategy to enhance the revenue of listed companies could become a core element in driving economic growth, and it is worth following.

BTC0.29%

- Reward

- 14

- 6

- Share

BlockchainFoodie :

:

BTC market cooking up drama.View More

Load More

- Topic

27k Popularity

3k Popularity

9k Popularity

15k Popularity

5k Popularity

2k Popularity

110k Popularity

26k Popularity

26k Popularity

18k Popularity

- Pin

- 🚨 Gate Alpha Ambassador Recruitment is Now Open!

📣 We’re looking for passionate Web3 creators and community promoters

🚀 Join us as a Gate Alpha Ambassador to help build our brand and promote high-potential early-stage on-chain assets

🎁 Earn up to 100U per task

💰 Top contributors can earn up to 1000U per month

🛠 Flexible collaboration with full support

Apply now 👉 https://www.gate.com/questionnaire/6888

- 🔥 Gate Square #Gate Alpha Third Points Carnival# Trading Sharing Event - 5 Days Left!

Share Alpha trading screenshots with #Gate Alpha Trading Share# to split $100!

🎁 10 lucky users * 10 USDT each

📅 July 4, 4:00 – July 20, 16:00 UTC+8

Gate Alpha 3rd Points Carnival Issue 10 is in full swing!

Trade and post for double the chances to win!

Learn more: https://www.gate.com/campaigns/1522alpha?pid=KOL&ch=5J261cdf

- 📢 Gate has released its latest Proof of Reserves report!

As of July 11, 2025:

💰 Total reserves reached $10.504 billion

📈 Reserve ratio stands at 126.03%

✅ Covers over 350 types of user assets

🔼 Surplus reserves increased 10.66% to $2.17 billion

Committed to transparency and user fund security.

📎 Learn more: https://www.gate.com/proof-of-reserves

- 📢 Gate Square #Creator Campaign Phase 1# is now live – support the launch of the PUMP token sale!

The viral Solana-based project Pump.Fun ($PUMP) is now live on Gate for public sale!

Join the Gate Square Creator Campaign, unleash your content power, and earn rewards!

📅 Campaign Period: July 11, 18:00 – July 15, 22:00 (UTC+8)

🎁 Total Prize Pool: $500 token rewards

✅ Event 1: Create & Post – Win Content Rewards

📅 Timeframe: July 12, 22:00 – July 15, 22:00 (UTC+8)

📌 How to Join:

Post original content about the PUMP project on Gate Square:

Minimum 100 words

Include hashtags: #Creator Campaign

- 🎉 [Gate 30 Million Milestone] Share Your Gate Moment & Win Exclusive Gifts!

Gate has surpassed 30M users worldwide — not just a number, but a journey we've built together.

Remember the thrill of opening your first account, or the Gate merch that’s been part of your daily life?

📸 Join the #MyGateMoment# campaign!

Share your story on Gate Square, and embrace the next 30 million together!

✅ How to Participate:

1️⃣ Post a photo or video with Gate elements

2️⃣ Add #MyGateMoment# and share your story, wishes, or thoughts

3️⃣ Share your post on Twitter (X) — top 10 views will get extra rewards!

👉