DefiPlaybook

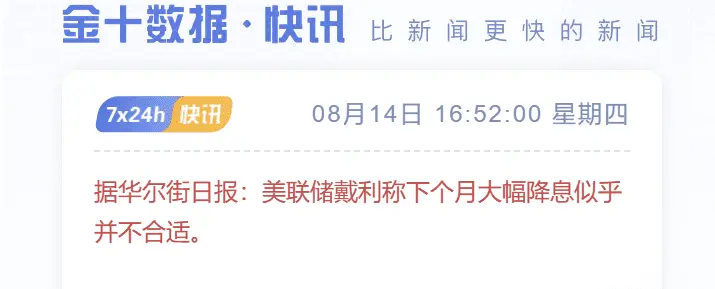

Recently, an intriguing piece of news has emerged from the economic community. Economist Mark Summerlin, who is seen as a potential candidate for the Fed chair, has put forward a bold suggestion. He believes that the Fed should take proactive measures next month and cut the interest rate by 50 basis points.

Summerlin, currently an economist at Evenflow Macro Consulting, pointed out that the current 4.3% federal funds Intrerest Rate level is too high and requires moderate adjustment. His view is mainly based on the current inverted yield curve phenomenon, which is often seen as a signal that th

View OriginalSummerlin, currently an economist at Evenflow Macro Consulting, pointed out that the current 4.3% federal funds Intrerest Rate level is too high and requires moderate adjustment. His view is mainly based on the current inverted yield curve phenomenon, which is often seen as a signal that th