IgnasDeFi

No content yet

IgnasDeFi

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

What do you call the strange phenomenon of really liking your current portfolio holdings?

- Reward

- like

- Comment

- Repost

- Share

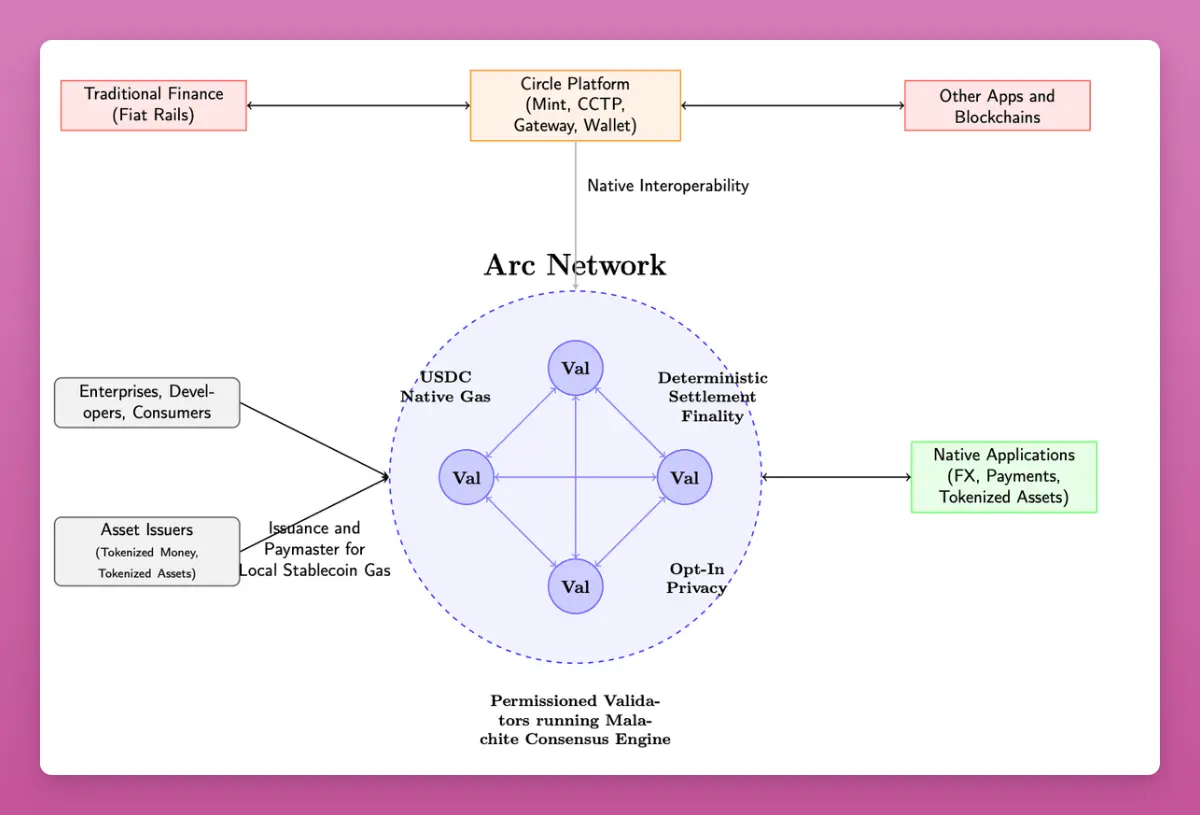

TL;DR - Circle's Arc

"Arc aims to be a top platform for tokenized, yield-bearing assets."

Centralization & TPS:

- Permissioned Validators: Regulated institutions (sic!) running a Tendermint-based PoA consensus (Malachite).

- ~ 3,000 TPS with a finality under 350 ms using 20 validators

- With four validators: 10,000 TPS, and finality is under 100 ms

In comparison, Solana pushes 4k-5k tps with 400-500 ms finality but SOL is more decentralized.

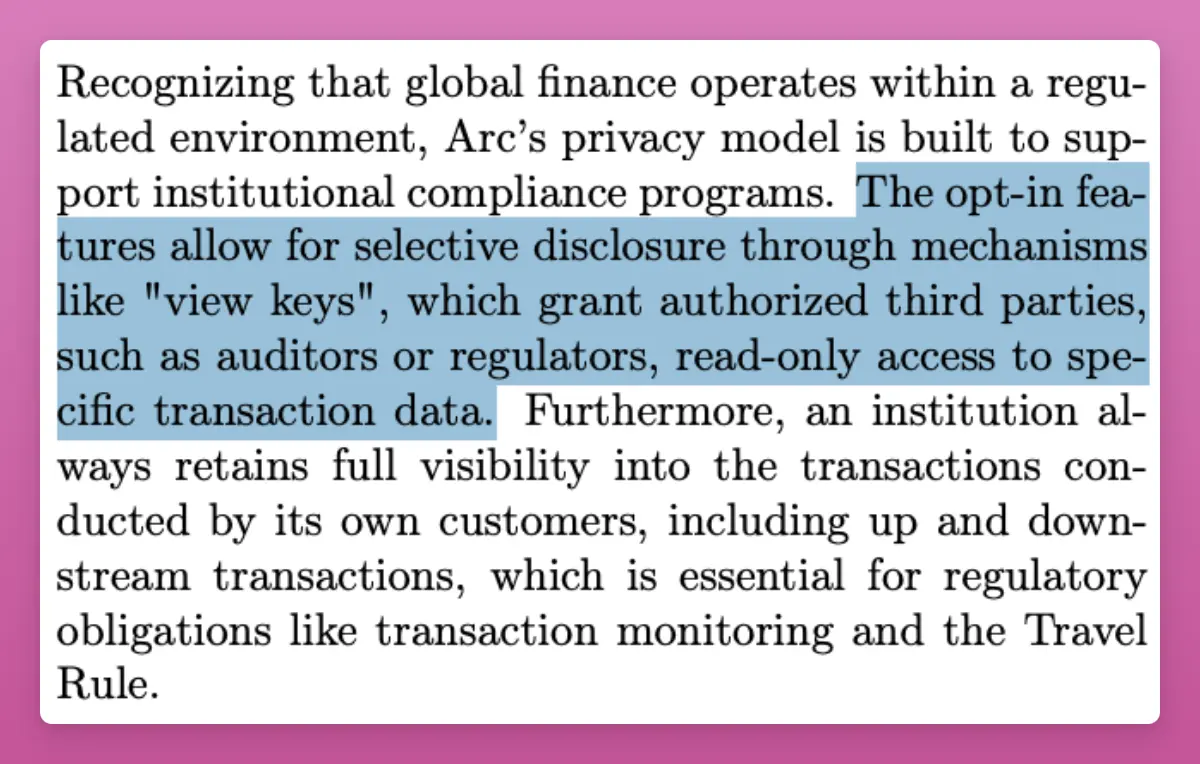

Privacy:

- Opt in Privacy: Confidential transfers (hidden amounts, visible addresses) with selective disclosure via "view key."

MEV:

- MEV Mitigation Road

"Arc aims to be a top platform for tokenized, yield-bearing assets."

Centralization & TPS:

- Permissioned Validators: Regulated institutions (sic!) running a Tendermint-based PoA consensus (Malachite).

- ~ 3,000 TPS with a finality under 350 ms using 20 validators

- With four validators: 10,000 TPS, and finality is under 100 ms

In comparison, Solana pushes 4k-5k tps with 400-500 ms finality but SOL is more decentralized.

Privacy:

- Opt in Privacy: Confidential transfers (hidden amounts, visible addresses) with selective disclosure via "view key."

MEV:

- MEV Mitigation Road

- Reward

- like

- Comment

- Repost

- Share

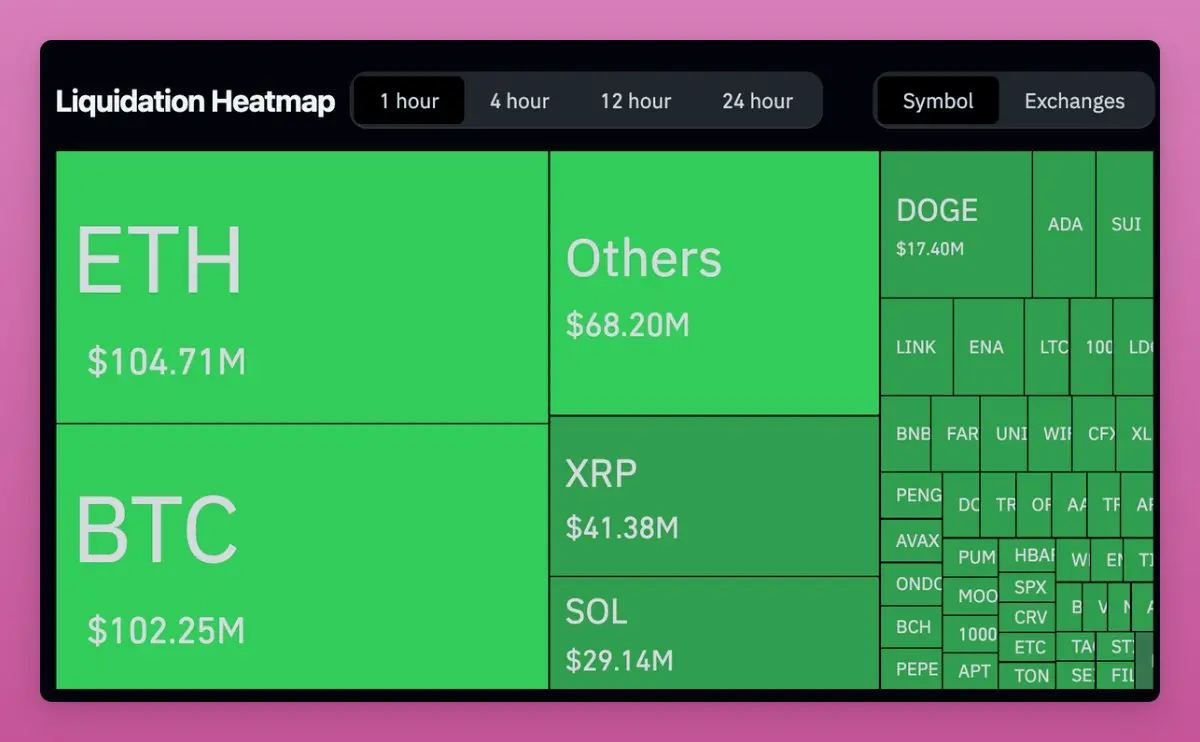

Crypto people around me are planning to sell.

Some are already offloading, particularly those for whom it's their 3rd cycle.

It's not just my environment: the retail vs large investor holdings chart shows that retail is selling to whales/institutions.

Btw, similar picture applies for ETH and BTC.

My worry: Will the buying power of institutions, DATs, and other whales offset the selling by the retail crowd?

Or will they run out of steam?

Ideally, it's a multiyear process and a steady price increase will shake out weaker hands gradually.

The most entertaining outcome would be crypto pumping even

Some are already offloading, particularly those for whom it's their 3rd cycle.

It's not just my environment: the retail vs large investor holdings chart shows that retail is selling to whales/institutions.

Btw, similar picture applies for ETH and BTC.

My worry: Will the buying power of institutions, DATs, and other whales offset the selling by the retail crowd?

Or will they run out of steam?

Ideally, it's a multiyear process and a steady price increase will shake out weaker hands gradually.

The most entertaining outcome would be crypto pumping even

- Reward

- like

- Comment

- Repost

- Share

Marginfi launched a points program 2 years ago. Still no token.

Despite launching early, Marginfi's TVL is dropping, while Kamino continues to grow.

I moved my assets from MarginFi to Kamino expecting a 'faster exit'.

Good call.

Surprisingly, even after the airdrop, I continued to use Kamino due to its useful features (multiply) and its more predictable token incentives campaign.

$KMNO just needs to pump to catch up with fundamentals.

Despite launching early, Marginfi's TVL is dropping, while Kamino continues to grow.

I moved my assets from MarginFi to Kamino expecting a 'faster exit'.

Good call.

Surprisingly, even after the airdrop, I continued to use Kamino due to its useful features (multiply) and its more predictable token incentives campaign.

$KMNO just needs to pump to catch up with fundamentals.

- Reward

- like

- Comment

- Repost

- Share

Popular crypto X account hacks with fake announcements to drain crypto seem to have stopped.

Been a while I saw one of those attacks.

Did X solve the vulnerability, or have scammers moved on to different tactics?

Been a while I saw one of those attacks.

Did X solve the vulnerability, or have scammers moved on to different tactics?

- Reward

- like

- Comment

- Repost

- Share

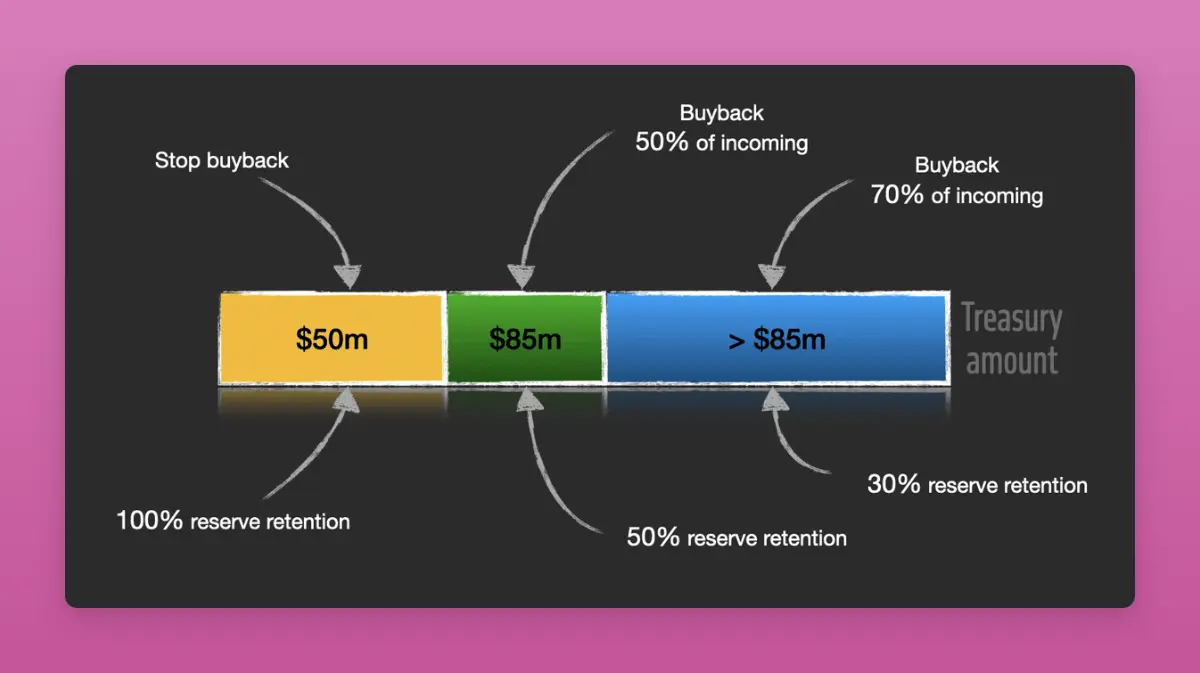

Lido DAO proposes a dynamic buyback of up to 70% for $LDO

With over $145M in stables and stETH sitting idle, the DAO is looking to return value to holders.

These assets generate no revenue. Time to put them to work.

The proposal:

• 70% of NEW incoming assets → $LDO buybacks

• 30% retained for ops & strategy

Why like this?

To ensure the DAO doesn't run out of development money.

There are some 'safeguard thresholds' the DAO should not cross.

- If Treasury sits between $50M and $85M, buybacks drop to 50%.

- If the liquid treasury falls below $50M, buybacks stop.

Great to see a DeFi giant being se

With over $145M in stables and stETH sitting idle, the DAO is looking to return value to holders.

These assets generate no revenue. Time to put them to work.

The proposal:

• 70% of NEW incoming assets → $LDO buybacks

• 30% retained for ops & strategy

Why like this?

To ensure the DAO doesn't run out of development money.

There are some 'safeguard thresholds' the DAO should not cross.

- If Treasury sits between $50M and $85M, buybacks drop to 50%.

- If the liquid treasury falls below $50M, buybacks stop.

Great to see a DeFi giant being se

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share